In the insurance industry, understanding and managing loss runs is crucial for both carriers and policyholders. A loss run report provides a detailed account of an insured party’s claim history. These reports offer critical insights that help in assessing risks and premiums. In this guide, we’ll go over the importance of loss run reports, their structure, and how automation with AI is transforming their management.

What Are Loss Runs?

Loss runs are detailed records of claims associated with an insurance policy. Typically generated by an insurance carrier, these reports include key details such as claim dates, types, financial data, and policy information. By providing a comprehensive view of an insured party’s claim history, they serve as a vital tool for assessing risks and making underwriting decisions. For insurance professionals, loss runs are indispensable for analyzing claim trends, identifying risks, and negotiating policy renewals.

The Importance of Loss Runs

The significance of loss runs extends across the insurance ecosystem. For underwriters, they provide a clear snapshot of a policyholder’s risk profile, forming the basis for renewal terms and conditions. Insurers rely on these reports to assess the overall claims experience, ensuring fair pricing and risk allocation. Policyholders benefit from the transparency offered by loss runs, which they can use to verify claims handling accuracy and address potential discrepancies. Moreover, organizations can analyze these reports to identify recurring patterns in claims, enabling them to implement proactive measures for risk mitigation and cost control.

A Look at a Typical Loss Run Report

To understand how loss runs work, consider the following example. A standard loss run report might include the following details:

| Claim Date | Claim Type | Paid Amount | Reserved Amount | Total Incurred | Status |

|---|---|---|---|---|---|

| 2024-01-15 | Property Damage | $15,000 | $5,000 | $20,000 | Closed |

| 2024-03-10 | Workers’ Compensation | $10,000 | $3,000 | $13,000 | Open |

| 2024-06-22 | Liability | $8,000 | $2,000 | $10,000 | Closed |

This structured format provides a clear overview of the claim history, making it easier for both insurers and policyholders to analyze the data and make informed decisions.

Overcoming Challenges in Managing Loss Runs

Despite their importance, managing loss runs can be a complex and time-consuming task. Many reports come in unstructured formats, making it difficult to extract and analyze data efficiently. Insurance companies often deal with high volumes of reports, and manual handling increases the risk of errors, inconsistencies, and delays. These challenges highlight the need for advanced technologies to streamline and optimize the process.

Transforming Loss Run Management with Automated Document Processing

Modern tools like Parsie are redefining how insurers, brokers, and claims professionals manage loss run reports—historically one of the most time-consuming and error-prone parts of the underwriting and quoting process. Parsie combines Optical Character Recognition (OCR) with Large Language Models (LLMs) to automate the extraction, structuring, and analysis of data from complex, unstructured documents.

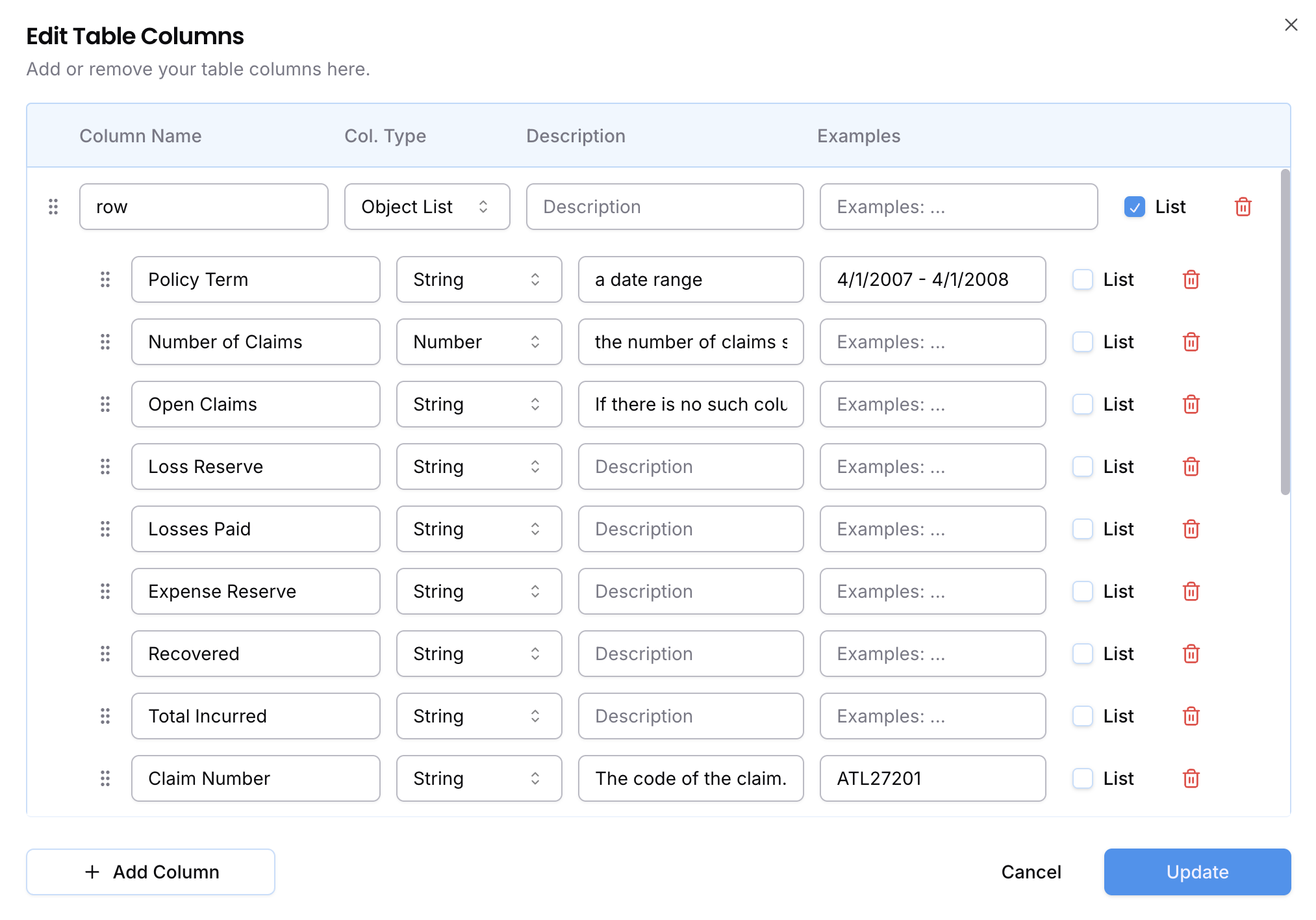

The process is simple but powerful. Users start by describing, in natural language, what data they want to extract—such as claim numbers, loss dates, paid amounts, reserves, or cause descriptions. From this input and a sample document, Parsie generates a data schema that defines which fields to extract, their data types (e.g., string, number, boolean), and optional metadata like field descriptions or examples. This schema can be created from scratch or adapted from Parsie’s ready-made loss run templates, giving teams flexibility depending on the specificity of their use case.

Once the schema is finalized, users can upload their actual loss run reports—whether in PDF, scanned image, Excel, or DOCX format. Parsie's AI engine then automatically parses each report, extracting and organizing claims data into structured tables. Each row typically corresponds to a single claim, making it easy to analyze trends, spot anomalies, or plug the data into downstream tools.

Parsie also offers an API that integrates directly with your systems to extract data from loss run reports as they arrive. You can sign up for a Parsie account and start testing API integrations — your first 20 pages are free.

The Benefits of Automation in Loss Run Processing

Automation brings a host of benefits to loss run management. First, it significantly reduces the time required for manual data entry, enhancing overall efficiency. Automated systems ensure consistency by standardizing report formats and reducing errors with AI-driven precision. They also offer scalability, enabling organizations to handle large volumes of reports without sacrificing accuracy. Moreover, by generating actionable insights from claim data, these tools empower insurers to make informed, data-driven decisions, ultimately improving operational effectiveness.

Conclusion

Loss runs are a cornerstone of the insurance process, offering transparency and detailed insights into claim histories. However, managing these reports manually can be a cumbersome and error-prone endeavor. With advanced solutions like Parsie, insurers can automate and optimize loss run management, achieving greater accuracy, efficiency, and scalability. Whether for underwriting or policy renewal, AI-powered document processing ensures that insurance professionals stay ahead in an increasingly competitive market.

Ready to transform your loss run management? Get started with Parsie today!