Extracting values from financial statement documents is a critical yet often overlooked aspect of financial management. Despite its importance, manual data extraction remains a widespread practice in many industries, leading to inefficiencies, errors, and increased operational costs. The question is no longer whether businesses should improve this process but how they can do so effectively. Moving beyond outdated manual workflows to adopt intelligent automation is key to transforming financial data extraction into a streamlined and accurate operation.

This article delves into the challenges posed by manual data extraction, explores the transformative capabilities of intelligent automation, and provides actionable insights to help organizations navigate this transition. Whether you’re a financial analyst, a business executive, or someone tasked with extracting values from complex PDF financial statements, this guide offers valuable strategies for enhancing efficiency, reducing errors, and optimizing workflows.

The Challenges of Manual Data Extraction in Financial Statements

Extracting data from financial statements is far more complex than it appears at first glance. Financial documents come in varied formats—structured, semi-structured, or unstructured—and often include tables, footnotes, and specialized terminology that are difficult to process manually. According to a Docsumo report, nearly 48% of manufacturing companies still rely on manual extraction methods despite their inefficiency.

Manual processes create multiple obstacles.

Firstly, time-consuming workflows are a major concern. Finance teams spend hours or even days sifting through countless pages of scanned PDFs, spreadsheets, and other formats to extract relevant data. This repetitive nature of manual extraction wastes valuable time that could otherwise be spent on analysis and strategic decision-making. For organizations managing large volumes of financial data, these inefficiencies compound over time.

Secondly, human error is inevitable in manual data extraction. A misplaced decimal, a skipped row, or an overlooked data point can lead to significant discrepancies in financial reporting. Research shows that the average error rate in manual processes can reach 40% (Source). Such inaccuracies can have far-reaching consequences, from flawed audits to incorrect financial planning, potentially jeopardizing business operations.

Finally, manual methods suffer from poor scalability. As businesses grow and handle increasingly complex financial datasets, manual extraction processes become unsustainable. The inability to scale efficiently results in bottlenecks that slow down operations, increase costs, and reduce overall productivity.

These challenges underline the urgent need for smarter, faster, and more accurate methods. Intelligent automation offers solutions that address these pain points directly, enabling businesses to extract values from financial statements efficiently and with precision.

The Rise of Intelligent Automation in Financial Data Extraction

Understanding Intelligent Automation

Intelligent automation represents a convergence of technologies that combine AI (Artificial Intelligence) and OCR (Optical Character Recognition) to streamline data extraction processes. While traditional OCR focuses on converting images into text, intelligent automation goes further by understanding the context, applying logical rules, and automating workflows. This makes it particularly suited to handling complex financial documents like balance sheets, income statements, and cash flow reports.

Modern solutions integrate advanced features that differentiate them from older technologies. These include:

- Cross-referencing across multiple documents: Ensuring consistency and identifying discrepancies in financial data.

- Smart document matching: Automatically aligning data points across related files.

- Metadata extraction: Capturing additional contextual information beyond the visible text.

The best tools combine OCR with intelligent automation features like cross-referencing, document matching, and smart snip tools, enabling organizations to extract values from PDF financial statements efficiently and at scale.

Why Intelligent Automation Works

Automated data extraction tools are designed to overcome the limitations of manual workflows. They can process vast amounts of data quickly, extract text values with high accuracy, and seamlessly integrate into existing financial systems like accounting software or ERP platforms.

For instance, AI-driven OCR solutions excel at recognizing unstructured data, handling multi-page documents, and extracting industry-specific terminology—all tasks that would be error-prone if done manually. Moreover, automation ensures scalability, allowing businesses to handle increasing volumes of financial data without compromising accuracy or speed.

The rise of intelligent automation marks a pivotal shift in how organizations approach financial data extraction. With the right tools, businesses can move beyond inefficiencies, unlocking opportunities for growth and operational excellence.

How Parsie Can Help

Parsie offers unmatched precision and scalability in extracting values from financial statements. Its cutting-edge algorithms and intuitive interface make it the ideal choice for businesses looking to optimize their workflows. Key advantages of Parsie include:

- High Accuracy: Achieve 99.99% accuracy in extracting and processing data.

- Scalability: Handle any volume of documents without bottlenecks.

- Cost Efficiency: Reduce operational costs while maintaining accuracy and speed.

Whether you’re processing invoices, balance sheets, or annual reports, Parsie provides solutions that elevate your financial data extraction processes.

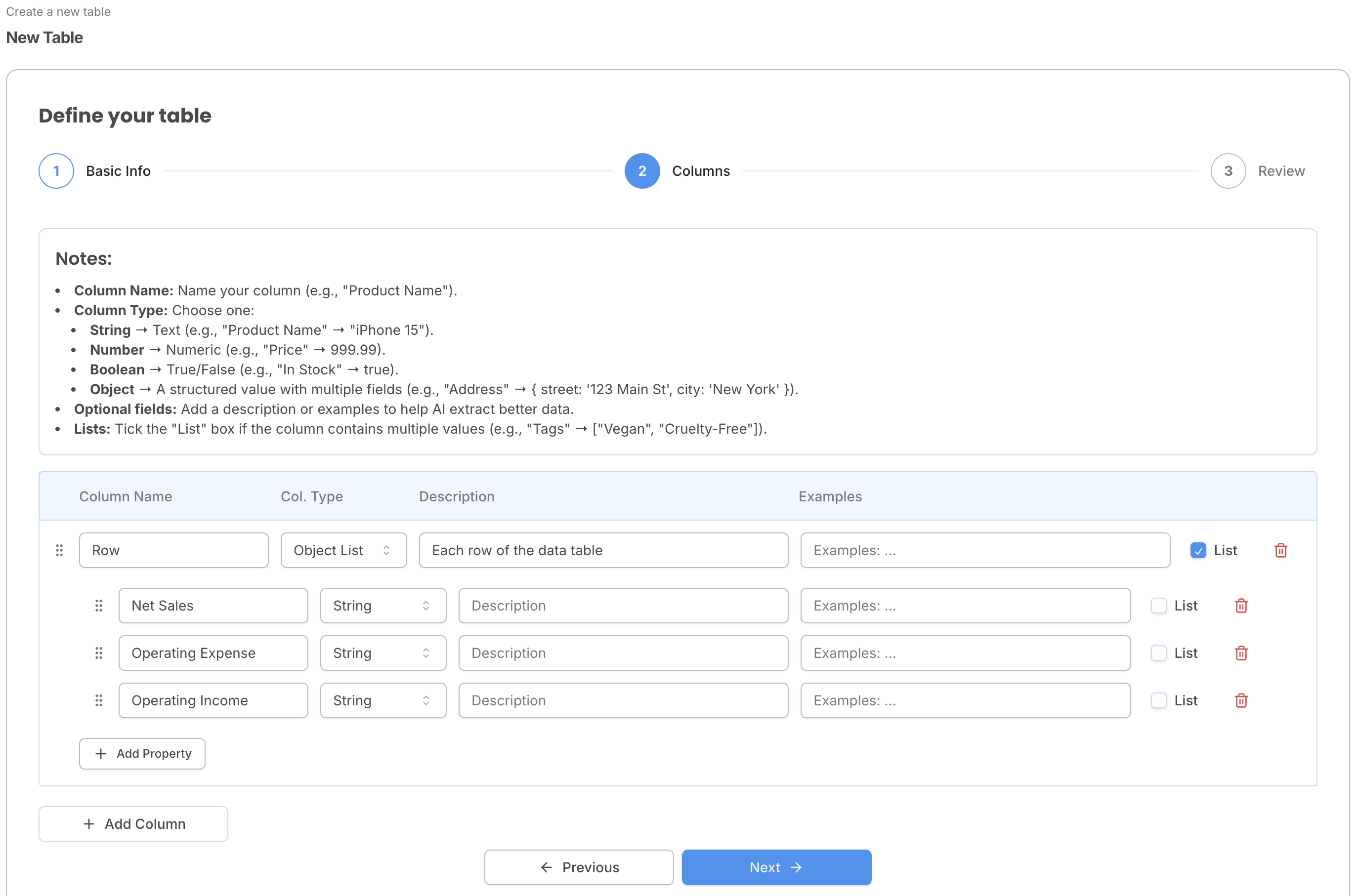

Let’s say you need to pull data from an annual report. Here’s how you can do it effortlessly:

- Upload the page containing the table as a PDF or image.

- Define Your Schema – Use Parsie’s AI-generated schema for automatic field detection or manually create one if you have specific fields in mind.

- Extract Data the Right Way – By default, Parsie processes each document as a single row. If you're extracting a table, be sure to tell the AI, and it will structure the data as a list of objects. When downloaded, this expands into multiple rows, just like the original table.

Need to extract transactions from a bank statement? Or convert a PDF bank statement to excel format? We’ve got a pre-built tool for that! Simply upload your statement and get an Excel file instantly.

Actionable Steps to Implement Automation in Your Organization

To successfully implement automation, organizations must take systematic steps to ensure a smooth transition:

Audit Your Current Processes

Begin by analyzing the bottlenecks in your current workflows. Identify areas where inefficiencies or errors are most prevalent.

Select the Right Tool

Evaluate automation solutions based on essential features like AI-powered OCR, cross-referencing, scalability, and integration capabilities.

Train Your Team

Provide comprehensive training to ensure your team can use the new tools effectively. Emphasize the time savings and reduced workload that automation enables.

Monitor and Improve

Use KPIs such as accuracy rates, processing speed, and cost savings to measure success. Continuously refine workflows based on feedback and results.

By following these steps, organizations can unlock the full potential of automation, transforming financial data extraction into a streamlined, accurate, and cost-effective process.

Conclusion

Extracting values from financial statements has long been a cumbersome task, but automation is rapidly changing the landscape. By adopting intelligent tools powered by AI and OCR, businesses can overcome the inefficiencies of manual methods, achieve unprecedented accuracy, and scale their operations effortlessly.

Tools like Parsie lead the charge, offering intuitive, precise, and cost-effective solutions to simplify the extraction process. It’s time for businesses to leave behind outdated workflows and embrace the efficiency, reliability, and scalability that automation provides.

Ready to transform the way you handle financial data? Explore Parsie’s solutions today and schedule a demo!