Loss run reports are one of the most frustrating parts of the insurance process. They often come as PDFs or scanned documents with inconsistent formatting, making it difficult to extract useful details like claim dates, paid amounts, reserves, and policy information.

Instead of spending hours manually copying data into spreadsheets, many teams now rely on software tools that can automatically extract and organize this information. These SaaS platforms use OCR and intelligent data processing to help brokers, underwriters, and claims professionals save time and reduce errors.

We’ve put together a list of some of the most effective tools available today, whether you're a solo broker, part of a growing agency, or working on a larger underwriting team.

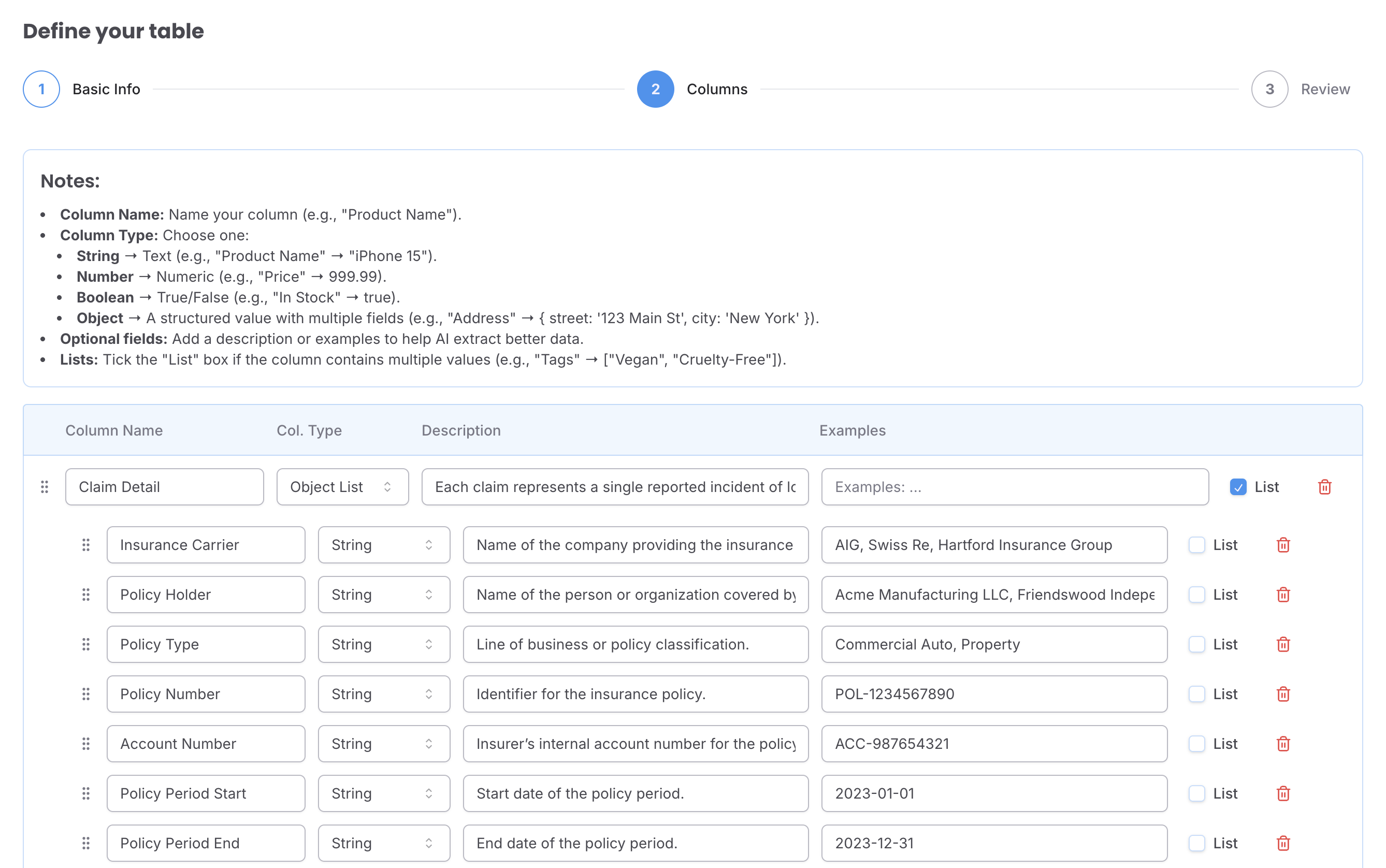

1. Parsie.pro

Parsie.pro stands out for its flexibility and speed. It lets users build custom parsing templates powered by LLMs, and handle difficult loss run layouts—including scanned PDFs and Excel. With a no-code interface, you can describe the fields you want to extract and quickly start extracting structured loss run data.

✅ Pros:

- Predefined template for parsing insurance loss run reports

- No code, adjust templates to your needs with plain English instructions

- API-first and easy to integrate into existing workflows

- Affordable usage-based pricing with credits that never expire

- Google Sheets and Zapier integrations

- No sales call required—test instantly with your own docs

❌ Cons:

- Not built solely for insurance—some manual tuning may be needed

- Advanced use cases may require more setup time

Best For: Brokers, automation agencies, and product teams who want full control over extraction logic without writing code.

2. Roots Automation

An insurance-focused platform that offers “Digital Coworkers” for processes like submission intake and loss run parsing.

An insurance-focused platform that offers “Digital Coworkers” for processes like submission intake and loss run parsing.

✅ Pros:

- Offers a specific Loss Run Extractor product

- Built for insurance carriers, brokers, and TPAs

- Fully managed solution—minimal setup on your end

- Can integrate with your policy or claims systems

❌ Cons:

- Less flexibility if you want to deeply customize logic or output

- Pricing is likely enterprise-tier (not self-serve or transparent)

- May not suit small agencies with light automation needs

Best For: Mid-to-large insurance firms looking for turnkey automation with minimal internal IT resources.

3. IntellectAI (Magic Submission)

AI-powered submission intake tool designed for commercial P&C underwriting, including support for loss run analysis.

✅ Pros:

- Built specifically for the insurance industry

- Supports loss runs, ACORD forms, SOVs, and more

- Offers automated classification, extraction, and risk scoring

- Designed to integrate into full underwriting workflows

❌ Cons:

- Likely requires a longer sales and onboarding cycle

- Tailored more to underwriters than brokers or agents

- Not as DIY-friendly as Parsie or other modular tools

Best For: Carriers, MGAs, or insurtechs doing high-volume submission intake.

4. CLARA Analytics

A claims analytics and document intelligence platform used by insurers and TPAs for risk evaluation.

✅ Pros:

- Supports intake and analysis of claims-related data

- Uses AI to extract insights from loss runs, claim notes, and medical documents

- Offers predictive modeling for claim outcomes

❌ Cons:

- Loss run parsing is part of a broader analytics suite—not a standalone product

- Focus is more on post-loss analysis than submission intake

- More relevant for carriers than brokers

Best For: Insurers looking to improve claims outcomes with analytics layered on top of structured loss run data.

5. Pibit.ai

Pibit.ai offers an AI-powered platform designed to automate the extraction and analysis of loss run documents, providing comprehensive insights to enhance underwriting efficiency.

✅ Pros:

- Specifically designed to handle loss run documents, offering features like loss summaries by year, claims summaries, and loss distribution analysis.

- Integrates with underwriting platforms, allowing for seamless incorporation of analytics into existing workflows.

❌ Cons:

- Detailed information on customization options and pricing is not readily available on the website, necessitating direct contact for specifics.

- May require training for teams to fully leverage the platform's capabilities, as suggested by the emphasis on tailored training programs.

Best For: Insurance carriers and managing general agents (MGAs) seeking a dedicated solution for loss run analysis to enhance underwriting processes.

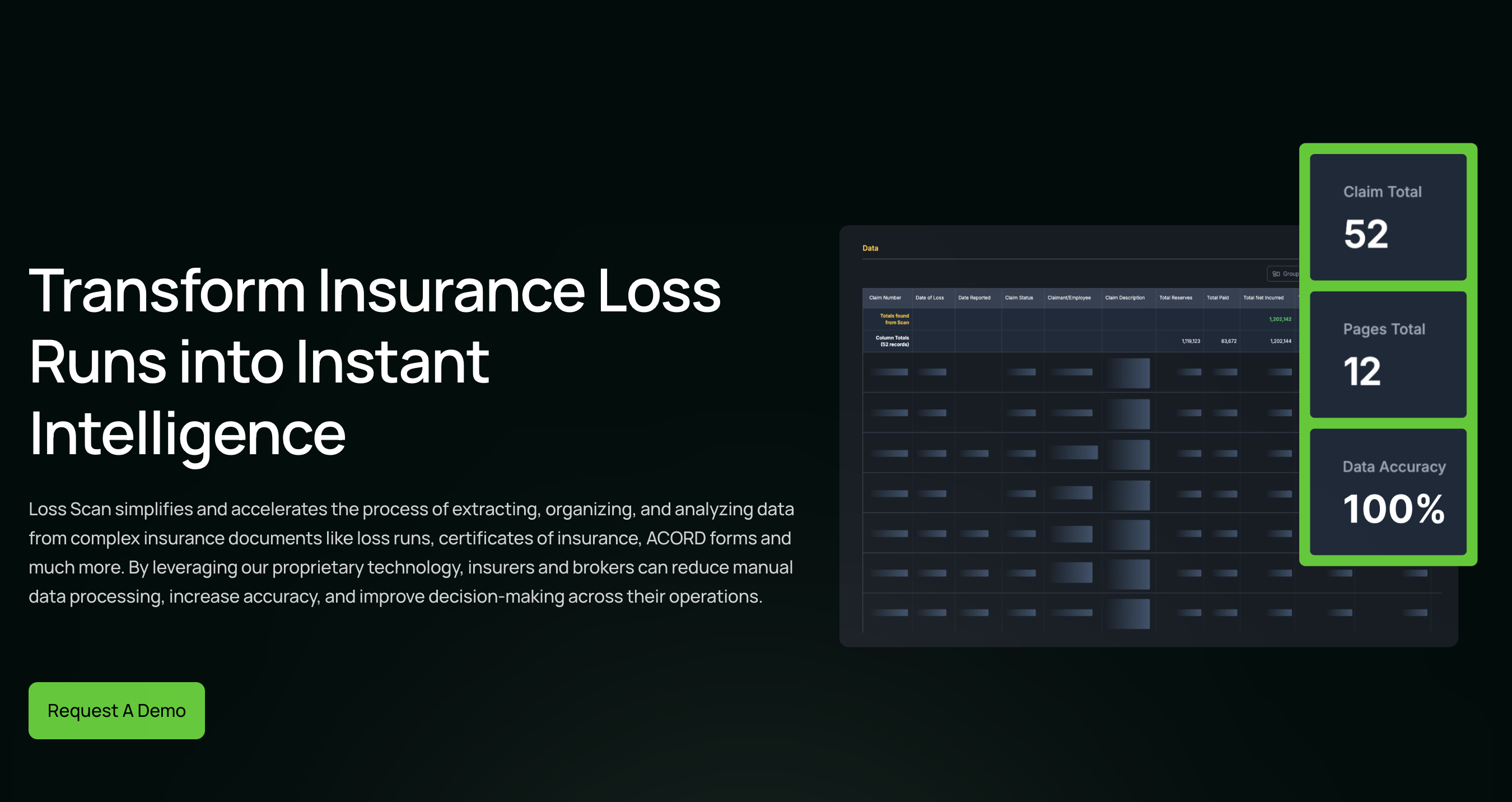

6. Loss Scan

Loss Scan provides an AI-driven tool aimed at transforming PDF insurance loss runs into actionable data swiftly, catering to insurance carriers and managing general agents.

Loss Scan provides an AI-driven tool aimed at transforming PDF insurance loss runs into actionable data swiftly, catering to insurance carriers and managing general agents.

✅ Pros:

- Designed to quickly convert PDF loss runs into usable data, streamlining the data extraction process.

- Offers integration with common insurance systems, facilitating seamless data flow within existing infrastructures.

- Emphasizes ease of use, aiming to reduce manual data processing and improve decision-making across operations.

❌ Cons:

- Primarily focuses on data extraction, with less emphasis on providing in-depth analytical tools for underwriting decisions.

- Specific details regarding pricing and customization options are not clearly outlined, requiring direct inquiry.

Best For: Brokers, MGAs, and insurance carriers looking for a straightforward solution to convert loss run documents into structured data efficiently.

7. Docugami

Docugami leverages AI-powered document engineering to extract and manage data from complex insurance loss run documents, aiming to improve risk assessment processes.

✅ Pros:

- Capable of handling diverse and complex document formats, extracting structured data effectively.

- Provides citations linking extracted data back to the original documents, enhancing transparency and traceability.

- Improves accuracy over time through user feedback, adapting to specific document structures and requirements.

❌ Cons:

- While effective, the platform is not exclusively tailored for insurance documents, potentially requiring additional configuration for optimal use in this sector.

- May necessitate a more technical setup and integration process, which could be a consideration for organizations without dedicated IT resources.

Best For: Insurance carriers and third-party administrators (TPAs) dealing with a variety of complex documents, seeking a robust solution for data extraction and management.

Final Thoughts

Whether you’re a broker drowning in loss run PDFs or a tech-savvy agency trying to streamline underwriting, there’s a SaaS tool here that fits. If you're looking for something affordable, flexible, and fast, Parsie.pro is an excellent starting point.

Want to try a free demo or need help integrating loss run parsing into your workflow? Schedule a demo or check out parsie.pro to see it in action.